Your annual budget is a kind of operating plan for your nonprofit so you can implement your vision for the impact you intend to have. It is also a form of communication; the numbers should reflect your organizational priorities and obligations, and even your values. Your operating budget is also a tool for analysis offering the raw material to make informed decisions about programs and expenditures.

Budget to support your vision

A well-crafted budget should help your nonprofit accomplish key goals and objectives. Your budget is a strategy document that can help you make tough decisions, and communicate with key constituents like your board, accrediting body, and funders.

Understand your baseline. Line up three consecutive years of budget history (two past, one current) to place next year’s budget in context. Three years of history* helps mitigate the effects of any single-year aberration and helps you spot telling trends in income and expenses. (*non-pandemic history, that is…)

Project into the future. Choose a three- or five-year time horizon and project forward so next year’s numbers make sense in the context of your nonprofit’s long-term vision. In a multi-year budget projection, you can show the anticipated impact of new investments, like a program introduced one year that will draw new support in the next. And you can begin to plan (and save) for future needs, whether capital or operating.

Identify risks and mitigants. Calling out the risks inherent in your budget (e.g., funding uncertainties, enrollment changes, increased program costs) can help you think critically and realistically about the future. Pair each risk with a viable plan (e.g., invest in fundraising, resize a program) to demonstrate that the budget is built on solid ground.

Prioritize based on strategy. Design a simple filter for budget decision-making with criteria such as: 1) fulfills a strategic objective; 2) meets a pressing need; and 3) is likely to attract needed support. Assign points to proposed initiatives with budget impact so decisions are weighed before finalizing.

Your budget tells a story

Your budget tells the story of your nonprofit in numbers: the organization’s financial health, its obligations, priorities, aspirations, and personality. Construct your budget with your audience in mind. You can even show it more than one way:

Funders like programs. Your donors want to see the impact their dollars have on the audiences you serve. Consider organizing your budget program-by-program rather than by administrative function and attribute a percentage of indirect costs (e.g., administration, facilities, fundraising, et.al.) to each program so that the cost of fulfilling your mission and realizing your vision (the “business” of your nonprofit) is crystal clear.

Boards like balance. It takes money to make money, so highlight any capacity-building investments you intend to make in your operating budget (e.g., an additional grant writer, a marketing campaign, a new earned income initiative), mapping each to a pay-off in increased revenue next year and the year after that.

Mind the gaps. Highlight potential gaps in your budget and provide more than one scenario for eliminating deficits in programs and overall. Give your staff and board members a way to identify roles that they can play in filling the gaps to realize your collective vision.

Decision makers like information. A budget narrative should accompany your budget and be more robust than mere footnotes. Peg your prose to each major budget category in a way that complements your spreadsheet, adding nuance and demonstrating a firm grasp of the numbers and their origin.

Budgeting is a team sport

Whether you start from scratch and “zero-base” your budget each year, or update the one that’s come before, budget-building is an opportunity for engagement and education. When key staff and board members get to know the numbers, they also “own” the numbers and share responsibility for the outcomes you wish to achieve.

Form a diverse committee. Engage a representative selection of staff in budgeting including those from program and fundraising. You’ll bring transparency to a process that can otherwise feel mysterious and you’ll gain important allies – ambassadors – in defense of sometimes difficult decisions.

Start the budget process early. Form your budget committee just after your mid-year budget review. Good budgeting takes time and may require research to support the cost of new initiatives or planned capital investments.

Keep the board focused. Your governing body’s time is best spent on overall organizational strategy and effectiveness – not “in the weeds.” Carefully construct your budget in a way that combines small and immaterial lines so you keep the focus on the big numbers that matter. Be sure to highlight the board’s role in generating resources and meeting fundraising goals.

Forecast quarterly. Set a regular budget review process that forecasts revenue, expenses and (importantly!) cash flow for the coming quarter. Share the numbers with your board finance committee and highlight projected increases, decreases and what you’ll do to address them. Adjust your budget formally right after mid-year if income projections are off, unexpected costs arise, or an opportunity too good to pass up has come along.

Good budgeting policies and practices

State and federal grant and funding reimbursement requirements, and the demands of philanthropic funders, have encouraged nonprofits to put important policies and practices in place to manage and monitor their budgets. Here are some policies and practices driven more by good sense than by demand:

Give staff latitude. Set a reasonable threshold for the approval of budget modifications during the fiscal year so staff members are empowered to make reasonable changes that don’t require management approval. You increase efficiency by giving department managers some control over changes that are unlikely to have a material impact on the organization overall. You also increase their managerial accountability.

Assign overhead methodically. Choose an appropriate methodology for calculating and assigning overhead, program-by-program; allocate by percentage of space, size of program, percentage of budget or a combination. The true cost of any program should always include both direct and indirect costs.

Keep the board at 30,000 feet. Set a reasonable threshold – by percent of overall budget – below which changes in budget allocations don’t need board approval. This keeps the board focused on larger trends and issues that have material impact.

Handicap your fundraising goals. When budgeting, enumerate the funding sources you can really count on; apply a small discount as a hedge for disappointment. For less-certain prospects, list the ask amount or grant requested for each; then apply a hefty discount (typically 66%) to set a credible projection.

Always compare YTD. Show year-to-date comparisons for immediate-past and current years when you report on budget performance each quarter. You’ll find the YTD comparisons alleviate concerns that are timing-related, and boost confidence in your financial picture overall when you’re doing better than last year.

Nonprofits can profit

Nonprofits can “profit” by generating a budget surplus each year. Budget surpluses are a good thing! (And funders, more and more, appreciate that.) Your surplus can provide the capital you need to build a healthy reserve fund; pilot new program initiatives; reinvest in technology, software or facilities; or to initiate long-range planning for growth.

Give your surplus a purpose. Because some funders still believe that only deficits demonstrate need, help them appreciate the value of a budget surplus with a well-crafted budget narrative that outlines a compelling use for it each year.

Build a healthy reserve. Put some surplus in the bank as operating capital. Three months’ payroll is a rule of thumb for cash-on-hand to run responsibly. Organizations that experience long delays in government reimbursements, or dramatic fluctuations in cash-flow cycles may need more.

Treat your reserve like endowment. Investment and spending policies designed to govern endowment should be applied to large reserves – sometimes called “quasi-” or “board-designated” endowment. Besides a reliable annual income stream from investment returns, quasi-endowment can make it easier to borrow money when it is time to finance a big project.

Leave depreciation to your auditor. Leave depreciation off the budget you present to your board and to funders (or put it “below the line”). Account for equipment and facility replacement costs in your operating expenses, nonetheless, so your audience understands the true cost of operations.

An Easy Approach to Program Portfolio Analysis

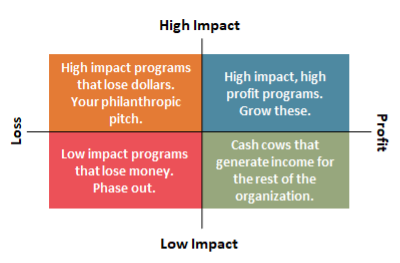

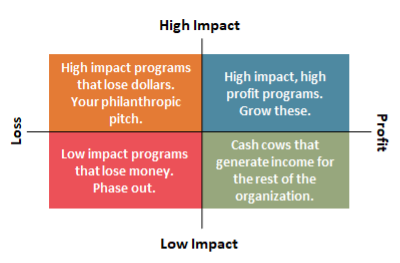

An effective rubric for making decisions about an organization’s program portfolio considers both the impact of a program and its financial profitability.

Assess impact. To get at impact, ask members of your senior team to rank the impact of each of your programs using a weighted average (a scale of 1-5) according to criteria such as:

- Alignment with core mission

- Quality of execution

- Number of individuals served relative to other programs

- Depth of service to individuals relative to other programs

- Fills a gap in community services/offerings

- Builds your reputation/public profile

- Leverages resources for other programs

Average the responses and plot each program on a scale of “High Impact” (5) to “Low Impact” (1) on the Y axis of a four-quadrant grid.

Assess profitability. Using each program’s P&L statement, which should include both direct and indirect (allocated) revenue and expenses, the program’s location on the graph’s x axis will shift to the right or left, according to the magnitude of profit or loss.

Analyze the results. A typical Program Portfolio Analysis results in four populated quadrants: 1) the top right quadrant (high impact/high profit) represents superstar programs; 2) the bottom right quadrant (low impact/high profit) represents “cash cows;” 3) the bottom left quadrant (low impact/low profit) represents programs to be phased out or redesigned; and 4) the top left quadrant (high impact/low profit) represents the programs that can be your strongest philanthropic pitch, assuming that there are appropriate sources of philanthropy.

Have the tough conversations. Are there programs or services you offer that no longer impact your constituents or meet your goals in ways that are central to your nonprofit’s mission? Are there programs or services that are too costly to maintain because they’re unlikely to ever draw sufficient resources or that drain your nonprofit of resources essential to your ongoing impact?